Frequently Asked Questions

-

Is there a cut off time for transactions?

All transactions must be made by 3:00 pm at Nevis & the Main branch; 2:00 p.m. at the Express Branch; 2:30 p.m. at Pine City, and 3:00 p.m. online.

- How can I transfer funds between accounts?

- How can I find out if a check has cleared, what my balance is, or the amount of my Direct Deposit?

- How do I set up a new direct deposit?

- What is the daily limit for ATM withdrawals?

- How do I find ATM locations with no fees?

- How do I place a stop payment on an item?

- Do I need to notify you if I plan to be traveling and using my debit card?

- Can I receive my bank statement electronically?

- What is Northwoods Bank’s routing number or ABA number?

- What are the bank’s hours?

- I recently moved. How do I change my address?

- How can I obtain my credit report and score?

- Is Bill Pay available?

- Is mobile banking available?

- How do I make an automatic payment for a Northwoods Bank loan?

- How do I cancel an automatic payment?

- How can I apply for a job at Northwoods Bank?

-

What will I need to open a checking or savings account?

In order to open an account with Northwoods Bank, you must have:

- A current, valid form of photo identification (a state-issued driver’s license or US passport)

- A tax identification number (most commonly, your social security number)

- Verification of current physical address (if not on driver’s license)

- One other form of identification (i.e. debit card, credit card)

- The minimum deposit amount applicable (typically $100)

Please call or visit one of our bank locations for more information. - How do I order [reorder] checks?

- Do you offer FREE checking?

- If I have a checking account and a loan, can I make an automatic loan payment?

- How do I view checks online?

-

What is a Certificate of Deposit?

A Certificate of Deposit (CD) is a product that pays a fixed interest rate for a set period of time. It is intended that the CD be held until maturity, at which time the money may be withdrawn together with the accrued interest.

- What do I need if I want to cash in my Certificate of Deposit?

- How long do I have after my maturity date to cash in my Certificate of Deposit?

- What are the early withdrawal penalty charges?

- Is my Certificate of Deposit covered by FDIC insurance?

- Will I receive a notice before my Certificate of Deposit matures?

-

How can I register for Online Banking?

Signing up for Online Banking is easy! You can sign up here.

- What are the features and benefits of Online Banking?

- What if I am traveling and need to log in to my accounts?

- What operating systems and browsers are supported?

- How do I change my Online Banking password?

- How do I view checks online?

- Why are some of my accounts not showing up online?

- Can I view all my transactions all the time?

- What if I need to log in to my account from a public computer?

- How often do I have to change my password?

- How secure is Online Banking?

-

What is the daily limit for a debit card?

The initial daily purchase limit is $1000, and the initial ATM daily cash limit is $500. You can request a change in these amounts. There may be a fee for a temporary debit card increase.

- My card is expiring soon. How do I get another one?

- Should I record my debit card transactions?

- I will be traveling; what do I need to do to ensure my ATM/Debit Card continues to work properly?

- How do I activate my debit card?

- How do I report a lost or stolen debit card?

- How long does it take to get a debit card?

- How do I get a debit card?

- What are the advantages of having a debit card?

- I do not remember my PIN for my ATM/Debit Card. How can I get another one?

- How does a debit card work?

- Can you select your own Personal Identification Number (PIN) for the debit card?

- What accounts can I access with a debit card?

- How long will it take for a purchase to be debited to my account when using a debit card?

- Can my card be rejected?

- Is there a surcharge fee for using my debit card at an ATM?

- How can I get a replacement debit card?

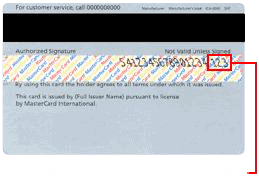

- What is a CVV Code?

-

How do I sign up to receive E-Statements instead of paper mailed statements?

You can sign up online or by contacting a personal banker.

- Is there any cost associated with receiving E-Statements?

- How do I view my statements online?

- How do I change the email address to which my E-Statement notifications are sent?

-

How do I sign up for Online Bill Pay?

You can enroll online through Online Banking or by contacting a customer service representative.

- Can I pay anyone?

- Can I cancel or place a stop payment on a bill payment?

- If there are not sufficient funds to cover a scheduled bill payment, what will happen?

- What determines if my payment is sent electronically or by check to my payee?

- How long does a check payment take to arrive using online bill pay?

-

How do I begin the mortgage loan process?

If applying for your first mortgage loan, the initial step you should take is to make an appointment at your local Northwoods Bank branch to discuss your options with a loan officer. You can also visit our Home Mortgage Loan Center to learn more information.

- What are the current mortgage interest rates?

- How much money will I have to come up with to buy a home?

- Should I use a real estate broker? How do I find one?

- How do I know if I can get a loan?

- In addition to the mortgage payment, what other costs do I need to consider?

- So what will my mortgage cover?

- What documents do I need to refinance my mortgage?

- What information do I need when applying for a home loan?

- How much can I afford?

- Should I refinance?

- What is a credit score?

- How can I obtain my annual credit report?

-

How do I protect myself from identity theft?

Our website has a list of resources which can help prevent and deal with identity theft.

- Are my deposit accounts covered by FDIC insurance?

- Do you have overdraft protection and how do I qualify?

- What type of security features do you provide?

- How secure is Online Banking?

-

What kinds of business loans do you offer?

We offer a variety of business loans including real estate loans, equipment loans, working capital loans, lines of credit and SBA loans. Please visit our lending center for more information.

- How do I apply for a business loan?

- What are your loan terms?

- How long does it take to get approved?

- What information do you ask for?

- Why do you need my personal tax returns?

- What do you look for when analyzing a business loan?

- Once I get approved, how long does it take to close the loan?

- What are your interest rates?

- Are there any additional fees for SBA loans?

Servicing Park Rapids, MN And The Surrounding Areas

Family owned and operated since 1919

Our team members greet you with a smile and the expertise you are looking for!